- A personal injury demand letter is the foundation of most pre-litigation settlements and often determines the upper boundary of negotiations.

- Insurance carriers evaluate demand letters using predictable internal frameworks focused on liability clarity, medical causation, and damages documentation.

- Poorly drafted or premature demand letters frequently result in undervaluation, delay, or denial.

- Policy limits, jurisdictional verdict trends, and timing significantly influence settlement leverage.

- Demand letters should be drafted as if they will later be scrutinized in litigation.

- Strategic demand drafting can reduce litigation costs while preserving escalation options.

Introduction: Why the Personal Injury Demand Letter Matters

In modern personal injury practice, the demand letter functions as more than a settlement request—it is often the first formal articulation of liability, damages, and legal posture. Industry data and insurer disclosures consistently indicate that a substantial majority of bodily injury claims resolve before a complaint is filed, with the demand letter serving as the primary valuation anchor during pre-litigation negotiations.

For attorneys, claims professionals, and litigation analysts, the personal injury demand letter is a strategic document that influences reserve setting, negotiation range, and litigation risk assessment. This is especially true in cases where damages are closely scrutinized, such as [slip and fall settlements without surgery], where the absence of a surgical “line item” makes the narrative of the demand letter even more critical to the case value. In these claims, the demand letter often determines whether a matter resolves efficiently or stalls over disputed injury significance.

Because demand letters may later be evaluated by defense counsel, mediators, or courts, they must balance factual precision with strategic restraint. A well-crafted demand letter presents a defensible narrative supported by evidence, positioning the claim for resolution while preserving escalation options if negotiations fail.

What Is a Personal Injury Demand Letter?

A personal injury demand letter is a formal written communication sent to an opposing party or insurer outlining liability, injuries, damages, and a proposed settlement amount. It typically precedes litigation and serves as the opening position in settlement negotiations.

Legal Purpose and Settlement Function

The legal purpose of a personal injury demand letter extends beyond initiating negotiations. It establishes a formal record that the claimant has identified the legal basis of liability, quantified damages, and offered an opportunity for resolution prior to litigation. This record can later be significant in evaluating settlement conduct, particularly where delay, unreasonable denial, or claims-handling practices are challenged.

From a settlement perspective, the demand letter anchors negotiations. Insurers often use the demand as the reference point for setting initial reserves and determining settlement authority. A well-supported demand communicates that the claim has been thoroughly vetted and that litigation, if necessary, will be supported by evidence rather than speculation.

Demand letters also shape expectations. They define the claimant’s valuation logic and signal how aggressively the claim will be pursued. When drafted carefully, they encourage insurers to engage substantively rather than defaulting to formulaic low offers. Conversely, poorly articulated demands often result in standardized responses or prolonged silence, delaying resolution and increasing costs.

When a Demand Letter Is Used in the Claim Lifecycle

Timing is a critical determinant of a demand letter’s effectiveness. Demand letters are typically most effective once liability investigation is complete and the claimant’s medical condition has stabilized. Submitting a demand before treatment concludes often forces insurers to discount damages due to uncertainty regarding prognosis, future care, or permanency.

In practice, demand letters are commonly sent after maximum medical improvement or once a reliable long-term treatment plan is established. This allows the letter to present a complete damages picture, including future medical needs or residual impairment. In cases involving statutory notice requirements or pre-suit demand rules, timing must also align with procedural deadlines.

Strategically, demand letters may be delayed in complex cases to allow for additional documentation or expert input. However, excessive delay can reduce leverage if insurers perceive diminished urgency. Effective timing balances informational completeness with procedural momentum, ensuring the demand arrives when it can be evaluated fully and responded to meaningfully.

Key Takeaways

- Demand letters operate as both negotiation tools and legal records.

- Timing directly affects credibility and settlement posture.

Core Elements of an Effective Personal Injury Demand Letter

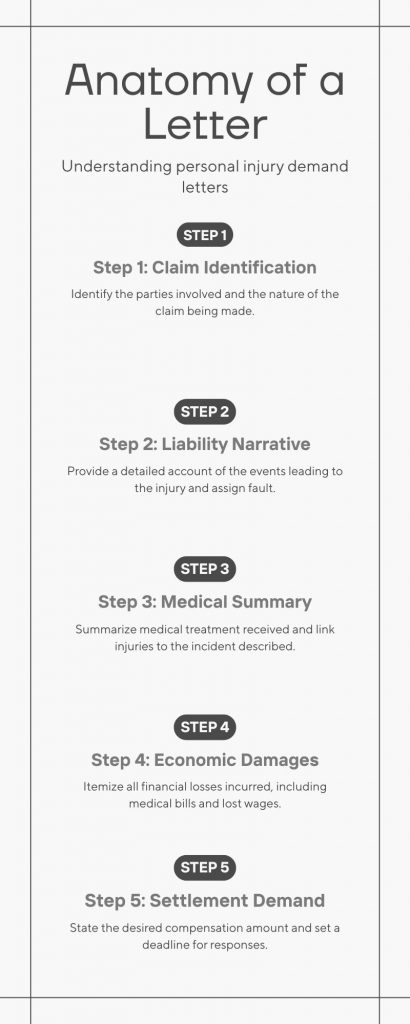

An effective demand letter follows a structure that aligns with how insurers and defense counsel evaluate claims.

Liability Overview and Factual Background

The liability section of a demand letter must establish fault clearly and efficiently. This involves more than reciting facts—it requires framing those facts within applicable legal standards. A concise chronology of events should identify the negligent acts or omissions, supported by objective evidence such as police reports, witness statements, or admissions.

Clarity is essential. Ambiguous descriptions or excessive narrative can obscure liability rather than strengthen it. Demand letters should anticipate potential defenses, such as comparative negligence or intervening causes, and address them directly where appropriate. Acknowledging and rebutting foreseeable defenses enhances credibility and reduces insurer skepticism.

Liability framing should also reflect jurisdictional nuances. Standards of care, fault apportionment rules, and evidentiary presumptions vary by venue and influence settlement posture. By aligning factual presentation with governing legal principles, the demand letter demonstrates preparedness and reduces the likelihood of liability-based discounting during negotiations

Medical Treatment, Causation, and Injury Summary

Medical causation is often the most contested component of a personal injury claim. Demand letters must clearly connect the incident to the injuries claimed, using treatment timelines, diagnostic findings, and provider assessments. Unsupported assertions of injury are frequently discounted, regardless of severity.

Effective demand letters summarize treatment chronologically, highlighting diagnostic consistency and medical necessity. Gaps in treatment, pre-existing conditions, or alternative causation theories should be addressed proactively rather than ignored. Silence on these issues invites insurer skepticism and valuation reductions.

Future care considerations, if applicable, should be supported by medical opinion or treatment plans rather than speculation. Demand letters that acknowledge uncertainty while presenting substantiated projections tend to carry greater credibility. The goal is not to exaggerate injury, but to demonstrate that medical conclusions are evidence-based and defensible.

Damages Breakdown (Economic and Non-Economic)

Damages analysis translates injury into quantifiable exposure. Economic damages should be itemized clearly, supported by billing statements, wage verification, and other documentation. Insurers routinely verify these figures, and discrepancies undermine trust.

Non-economic damages require careful framing. Rather than emotional appeals, effective demand letters contextualize pain and suffering through duration, functional limitations, and impact on daily activities. Jurisdictional norms and comparable verdicts may inform valuation but should not be overstated.

Demand letters should explain how the total demand figure was calculated, even if not itemizing every component. Transparency reduces friction during negotiation and signals that the demand is grounded in analysis rather than aspiration.

Supporting Documentation and Exhibits

Supporting documentation transforms a demand letter from advocacy to evidence. Each exhibit should be referenced clearly within the letter and organized logically. Disorganized or excessive documentation can obscure key facts and frustrate review.

Medical records should be curated to highlight relevant treatment and diagnoses, avoiding unnecessary volume. Billing summaries should reconcile totals and identify outstanding balances. Employment records, photographs, and expert opinions should be included only where they materially support damages claims.

Clear labeling and indexing improve usability. Demand letters that respect the reviewer’s time are more likely to receive prompt and substantive responses.

Key Takeaways

- Documentation drives valuation.

- Unsupported assertions undermine settlement leverage.

How to Write a Demand Letter for Personal Injury Claims

Knowing how to write a demand letter for personal injury claims requires more than summarizing medical records and assigning a settlement figure. The process involves translating factual evidence into a structured legal narrative that insurers can evaluate using established claims-handling frameworks. A properly written demand letter demonstrates that liability has been analyzed, damages have been calculated, and litigation readiness exists if settlement fails.

From a drafting perspective, the letter should follow a disciplined structure—liability, causation, damages, and demand rationale—mirroring how the case would be presented if filed. This approach reduces friction during review and signals professionalism. Effective demand letters avoid emotional appeals and instead rely on documentation, consistency, and defensible valuation logic.

Structuring the Letter for Clarity and Persuasion

Structure influences comprehension. Demand letters should follow a predictable format that allows reviewers to locate information quickly. Headings, summaries, and logical sequencing enhance readability without sacrificing substance.

A strong structure mirrors litigation logic: liability, causation, damages, and demand rationale. This familiarity reduces cognitive friction and signals professionalism. Paragraph length should be controlled to avoid dense blocks of text.

Clarity does not mean oversimplification. Complex cases benefit from structured explanation rather than abbreviation. The objective is to guide the reader through analysis, not overwhelm them

Language, Tone, and Legal Positioning

Tone communicates confidence. Demand letters should adopt a professional, measured voice that reflects readiness without hostility. Inflammatory language often provokes defensive responses and delays negotiation.

Statements should be factual and supported, avoiding speculative or conclusory assertions. Where legal conclusions are drawn, they should be grounded in evidence and framed cautiously.

Tone also affects later proceedings. Demand letters may be scrutinized by mediators or courts, making restraint and consistency essential.

Common Drafting Mistakes That Reduce Claim Value

Common errors include overstating damages, ignoring adverse facts, and submitting incomplete documentation. These mistakes invite insurer skepticism and reduce settlement efficiency.

Another frequent mistake is inconsistency between demand letters and later negotiation positions. Shifting narratives undermine credibility and complicate resolution.

Avoiding these errors requires discipline, review, and alignment with litigation strategy.

Key Takeaways

- Demand letters should read like trial-ready summaries.

- Credibility outweighs theatrics.

Demand Letter to an Insurance Company — Strategic Considerations

A demand letter to an insurance company must be drafted with an understanding of how claims are internally reviewed and valued. Insurance carriers rely on structured evaluation models that assess liability clarity, injury classification, treatment duration, and jurisdictional risk. Demand letters that align with these criteria are more likely to receive substantive responses rather than standardized denials or low initial offers.

Adjusters are trained to identify documentation gaps, causation weaknesses, and inconsistencies between claimed damages and medical records. A well-prepared demand letter anticipates these review points and addresses them directly, reducing the likelihood of prolonged back-and-forth requests for additional information

How Insurance Adjusters Evaluate Demand Packages

Adjusters rely on standardized evaluation models. They assess liability clarity, injury classification, treatment duration, and venue risk. Demand letters that align with these criteria facilitate evaluation.

Claims that lack documentation or present unresolved causation issues are often discounted pending further review. Understanding adjuster workflows allows drafters to anticipate information needs

Timing the Demand for Maximum Leverage

Timing affects leverage. Early demands risk undervaluation; late demands may reduce urgency. Strategic timing balances completeness with momentum.

Consider statutory deadlines, treatment status, and insurer responsiveness when determining timing.

Key Takeaways

- Insurer evaluation is systematic and predictable.

- Strategic timing can materially affect settlement outcomes.

Policy Limits and High-Exposure Demand Letters

A personal injury demand letter policy limit issue arises when claimed damages approach or exceed available insurance coverage. In these situations, the demand letter carries legal significance beyond negotiation, as it may later be evaluated in the context of insurer good-faith obligations.

Policy-limit demands must be precise, unambiguous, and compliant with jurisdictional requirements. Failure to clearly articulate exposure, damages support, or response deadlines may weaken later arguments regarding unreasonable claims handling. Conversely, a properly framed policy-limit demand preserves leverage while allowing insurers a meaningful opportunity to resolve the claim within coverage constraints.

Personal Injury Demand Letter Policy Limit Issues

Policy-limit demands must comply with legal requirements. Ambiguity or noncompliance can undermine enforcement options.

Clear articulation of exposure and compliance with procedural rules preserves leverage and credibility.

Excess Exposure and Reservation of Rights

High-exposure cases require careful signaling. Demand letters should identify exposure without threatening language, preserving professional tone.

Key Takeaways

- Policy-limit demands carry legal consequences.

- Precision protects future enforcement options.

Demand Letters in Car Accident Settlement Claims

Motor vehicle claims present unique evidentiary and valuation challenges.

Demand Letter for Car Accident Settlement Claims

A demand letter for car accident settlement claims must account for factors unique to motor vehicle cases, including accident mechanics, property damage correlation, and standardized insurer defenses. Insurers often rely on vehicle damage assessments and biomechanical assumptions when evaluating injury severity, particularly in soft-tissue cases.

Effective demand letters address these assumptions directly by correlating medical findings with collision dynamics and treatment chronology. Where multiple vehicles or commercial coverage are involved, the letter must also clearly identify insured parties and applicable policies to avoid evaluation delays

Multi-Vehicle and Commercial Auto Claims

Complex coverage requires precise identification of parties and policies. Demand letters should eliminate ambiguity to prevent delay.s.

Key Takeaways

- Auto claims demand tailored factual framing.

- Impact mechanics and causation matter.

Negotiation, Counteroffers, and Next Steps After the Demand

Submitting a demand letter initiates negotiation, not resolution.

Evaluating Counteroffers and Settlement Ranges

Counteroffers should be assessed objectively. Emotional responses or rigidity often stall negotiations.

Escalation Paths: Mediation or Litigation

Demand letters should anticipate escalation. Consistency between demand and litigation posture preserves credibility.

Conclusion: Demand Letters as Litigation Strategy Tools

A personal injury demand letter is not merely a settlement request—it is a strategic document that frames liability, damages, and negotiation posture. When drafted with precision, supported by evidence, and timed appropriately, demand letters can resolve claims efficiently while preserving litigation leverage.

For deeper analysis, practitioners often reference national trial advocacy guidance, insurer claims-handling standards, and civil litigation treatises when refining demand strategies and evaluating settlement posture.

Key Takeaways for Drafting Effective Personal Injury Demand Letters

- Demand letters should be drafted with the same discipline applied to pleadings and trial preparation, reflecting best practices discussed in American Bar Association civil litigation guidance.

- Understanding how insurers evaluate claims—particularly liability clarity and damages documentation—aligns with claims-handling principles outlined by the Insurance Information Institute.

- In auto-related injury claims, accident causation and severity assessments are often informed by data and analysis from the National Highway Traffic Safety Administration, which can indirectly influence settlement evaluation.

- Strategic demand drafting reduces unnecessary litigation while preserving escalation options consistent with recognized dispute resolution standards.

Frequently Asked Questions

How long should a personal injury demand letter be?

Length varies, but clarity and documentation matter more than volume. Most effective demand letters range from several pages plus exhibits.

Is a demand letter required before filing a lawsuit?

Generally no, but it is often strategically advantageous and may be required in limited statutory contexts.

Can a demand letter be used later in litigation?

Yes. Demand letters may be discoverable and can influence credibility or bad-faith arguments.

What happens if an insurer ignores a demand letter?

Non-response may justify follow-up demands, mediation, or litigation depending on deadlines and strategy.

Should demand letters always request the maximum possible amount?

Not always. Unsupported or excessive demands may reduce credibility and delay resolution.